BFSI Industry – Empowering Digital Transformation with Hridayam

In the fast-paced world of Banking and Financial Services (BFSI), where compliance, speed, and security define competitive advantage, outdated manual systems are no longer viable. Institutions face mounting pressure from regulators, customers, and internal leadership to digitize operations, enhance compliance, and mitigate risk.

Hridayam Soft Solutions understands the complex landscape of BFSI—from traditional banks and NBFCs to cooperative credit societies and insurance firms. Our solutions are designed to solve real operational problems, not just check a technology box.

Industry Challenges

Senior leaders in BFSI are no strangers to the operational bottlenecks that come with scale and regulation:

How Hridayam Helps

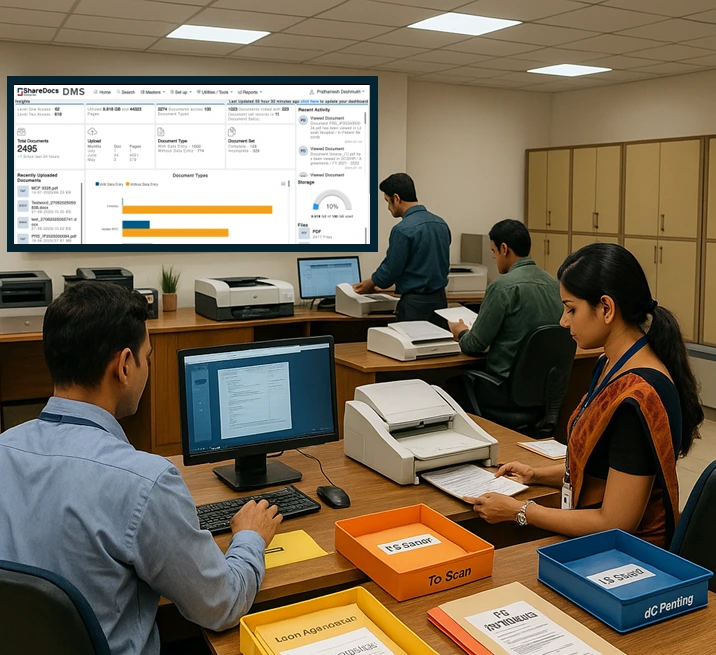

ShareDocs Enterpriser – ECM for BFSI

Digitize policy documents, KYC records, circulars, and customer agreements

AI-powered metadata extraction – account numbers, client IDs, dates

Office 365 ECM integration for collaborative reviews

Secure document workflow with audit trails and approvals

CKYC Processing Solution

Central KYC XML submission to CERSAI

Bulk CKYC validation tool

Compliance-ready workflows with audit logs

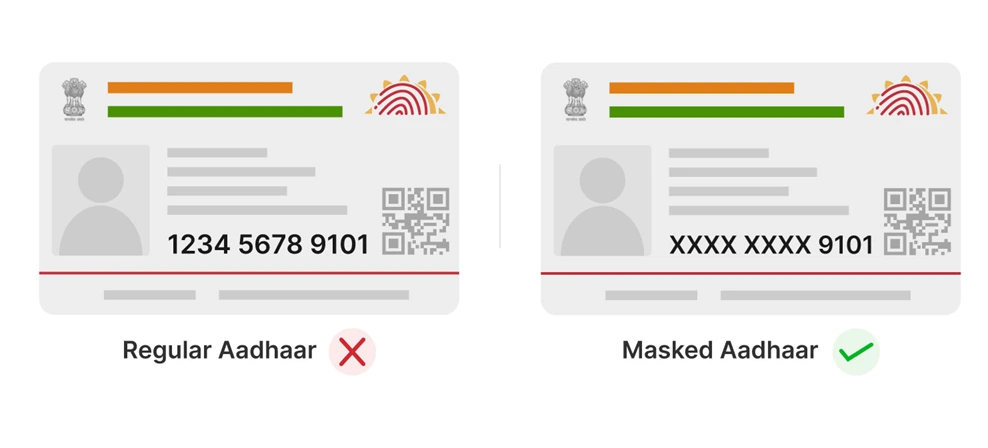

AI-Based AADHAR Masking Service

Compliant with UIDAI and RBI data privacy mandates

Available as API or via secure SFTP

Automated detection and masking of AADHAR numbers from scanned images or PDFs

Ideal for onboarding documents, loan forms, and KYC scans

HRDMS – Employee Onboarding Software

Remote onboarding tool for sales teams and field agents

HR workflow automation with e-sign and document upload

Compliance onboarding software aligned with RBI norms

FAMS – Fixed Asset Management Software

Barcode asset tracking software

Asset audit and inventory system with branch-wise logs

Asset depreciation tool aligned with Ind AS

Mobile asset scanning app for audit teams

Business Benefits for BFSI

Frequently Asked Questions

Can ShareDocs help with audit preparation?

Absolutely. You can retrieve contract approvals, client docs, and communications instantly.

Is the CKYC tool compatible with NBFC workflows?

Yes, it's built for banks, NBFCs, and insurers with bulk processing support.

Do we need training for HRDMS?

Minimal. It's built for HR teams with zero technical complexity.

Can FAMS track ATM infrastructure?

Yes. ATMs, UPS, air conditioners – all can be tagged and tracked.

Is the solution RBI and CERSAI compliant?

Yes. All modules follow RBI circulars and CERSAI formats.

Can we access these solutions via cloud?

Yes. All our platforms are cloud-based and scalable.

Does ECM support Office 365?

Fully integrated – including version history and co-editing.

Can onboarding workflows trigger emails to candidates?

Yes. Automated notifications are part of the workflow.

How long does a CKYC file take to process?

Usually under 30 seconds after data validation.

Does AADHAR masking work on scanned PDFs?

Yes. Our AI engine detects and masks AADHAR numbers in both images and text-based PDFs.

Can the AADHAR masking tool be integrated with our DMS?

Yes, via API or SFTP workflows.

Sign up to our webpage

Stay up to date with the latest update and announcement.

Email: info@hridayamsoft.com

Phone: +91-915201 7447/48/49/50

Address:

501, Thakkar Heights,

Village Road, Opposite CEAT Tyres,

Nahur West, Mumbai – 400078, India